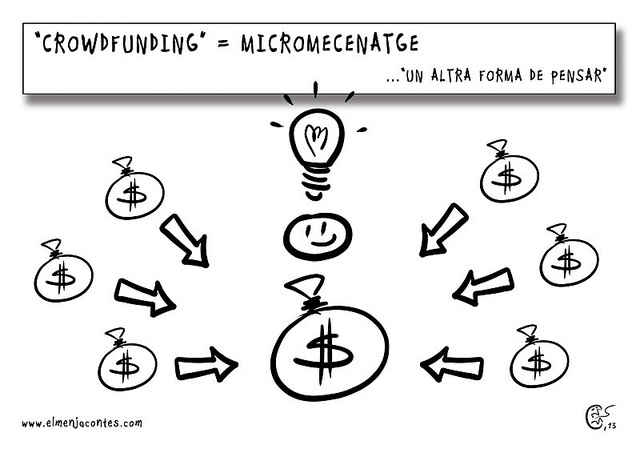

Equity crowdfunding is much like crowdfunding, which has been popularized in the United States through sites such as Kickstarter and Indiegogo. The difference is that instead of individuals supporting campaigns through donations, numerous investors are purchasing small stakes in startups or small businesses. Critics of crowdfunding worry that the industry will be rife with Ponzi schemes or that having too many investors will hurt startups’ prospects for future funding.

One glaring obstacle, according to Director of Research Richard Swart, who oversees crowdfunding research at Berkeley, is the lack of crowdfunding auditors.

“There also needs to be a better way of doing financial audits,” Swart said. “There’s a big gap in the market when it comes to auditing small businesses or early-stage startups. The Big Four accounting firms just don’t have it covered yet. Most startups don’t have great financial accounting. It will take some time for the market to mature. You will probably see institutional investors experiment with equity crowdfunding before you see individual investors. 90% of America doesn’t even know what equity crowdfunding is.”

Swart believes equity crowdfunding will be attractive to “Main Street USA” businesses with loyal customers, but especially attractive to tech startups that do not want to deal with venture capital funds.

“I wouldn’t be surprised if we saw large pools of investment, say 20-40 million dollars,” he said. “They might just find that the costs of capital are much lower with equity crowdfunding. It’s better than dealing with VCs. A lot of people are worried that equity crowdfunding might create problems for startups who later want to seek venture capital money. However, you might see a new convertible instrument, where instead of debt being converted to equity, you will see equity turned into debt. The debt will have a much higher interest rate, so as to make it attractive to the earlier investors, and so that VCs will be wiling to invest in certain companies.”