By Ataberk Sevim, MEng ’22 (IEOR)

This op-ed is part of a series from E295: Communications for Engineering Leaders. In this course, Master of Engineering students were challenged to communicate a topic they found interesting to a broad audience of technical and non-technical readers. As an opinion piece, the views shared here are neither an expression of nor endorsed by UC Berkeley or the Fung Institute.

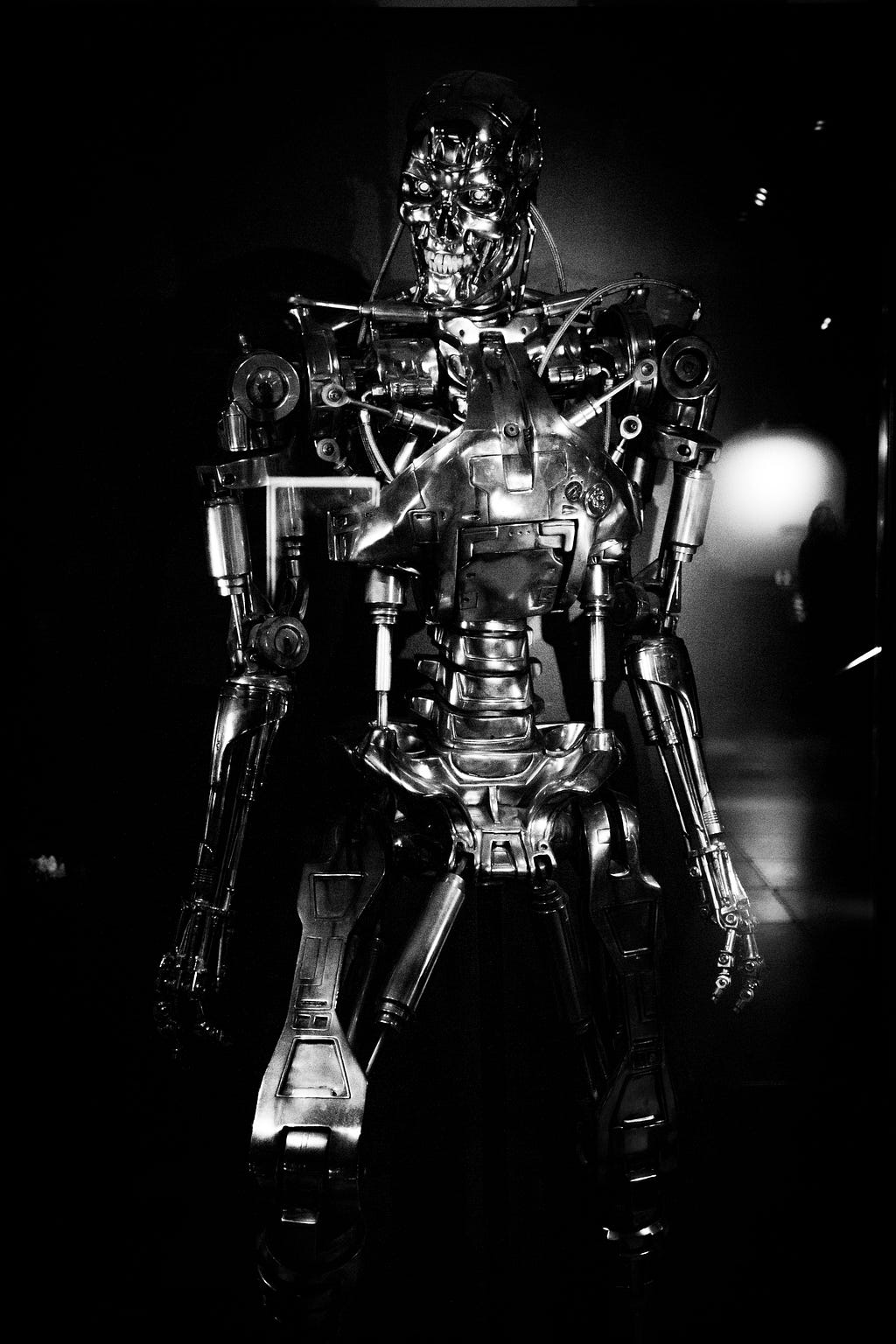

Op-Ed: Will the next Skynet be an algorithmic bot? was originally published in Berkeley Master of Engineering on Medium, where people are continuing the conversation by highlighting and responding to this story.