The Securities and Exchange Commission (SEC) voted today on the rules for crowdfunding. Now, a new form of crowdfunding will allow start-up companies to raise money by selling stock to Main Street investors. For those investors, this means getting an early “in” on start-up companies–the next Twitter, Uber etc.–while also making a small profit. Click to learn more about the ruling and what it entails.

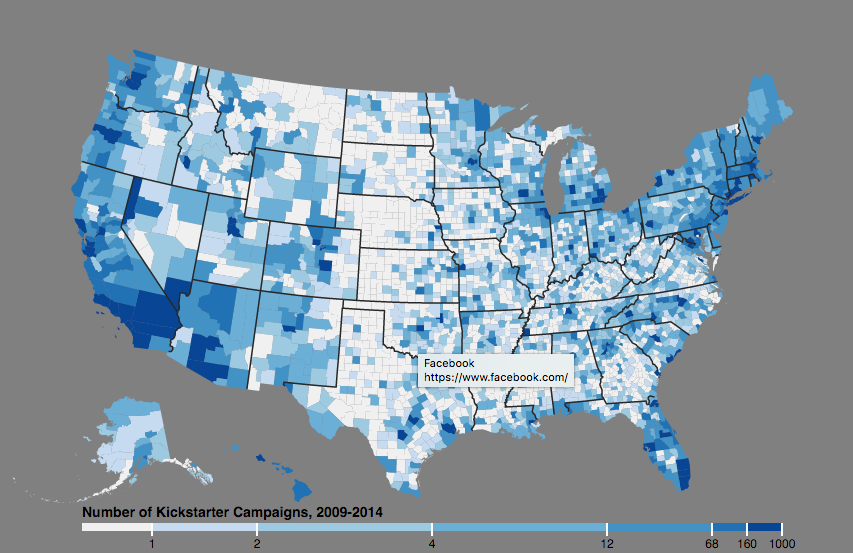

The hope is that crowdfunding will increase access to entrepreneurial finance for deserving but underserved communities. The Kauffman Foundation supports research on the topic here at the Fung Institute; for example, here is a graphic prepared by Jason Boada, MEng 2015, that shows Kickstarter campaigns by county. It’s interesting that crowdfunding doesn’t necessarily cluster in the core tech regions like Silicon Valley and Boston but in other regions as well, like Southern California or Southern Florida (to name a couple).