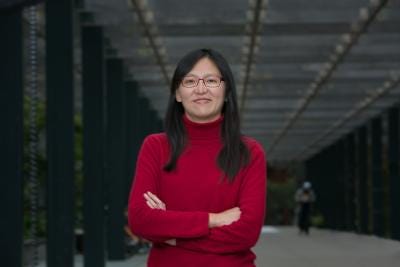

Professor Xin Guo: ‘In the old days, people used pen to crunch data. Now, we use tech’

By Jessie Ying

Why did you want to create a FinTech concentration?

My research interests have a very natural connection to finance and economics. I see more students that have taken financial engineering courses with me went on to work for companies like Google and Facebook instead of on Wall Street. Some of my PhD students did the same thing. So, I thought: Since we are in Silicon Valley, why don’t we do this — push for FinTech? We are very lucky that we have the MEng platform and a lot of faculty support. We are the first in the nation to do this and got a huge number of applications. We are having a very good start.

What sets FinTech Capstone projects apart?

Usually, the problems in the finance industry are the most challenging ones because they got the smartest people trying to make money. The key of the FinTech program is really the Capstone. A cool part about our Capstone is that although we fix the scope of the problems, we change the details depending on the students. If the group is more advanced, we adapt the problems to more challenging topics.What does a typical Capstone project in FinTech look like?

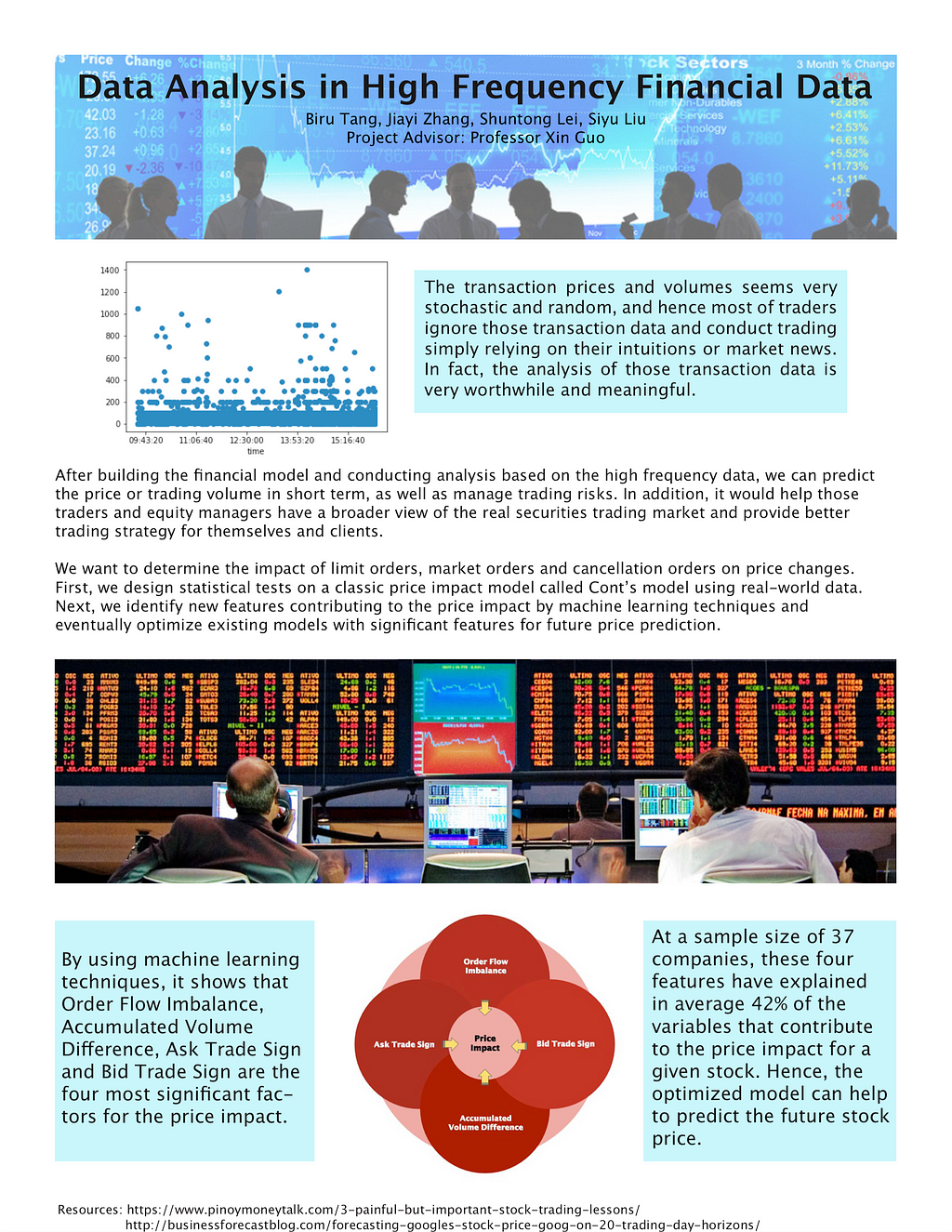

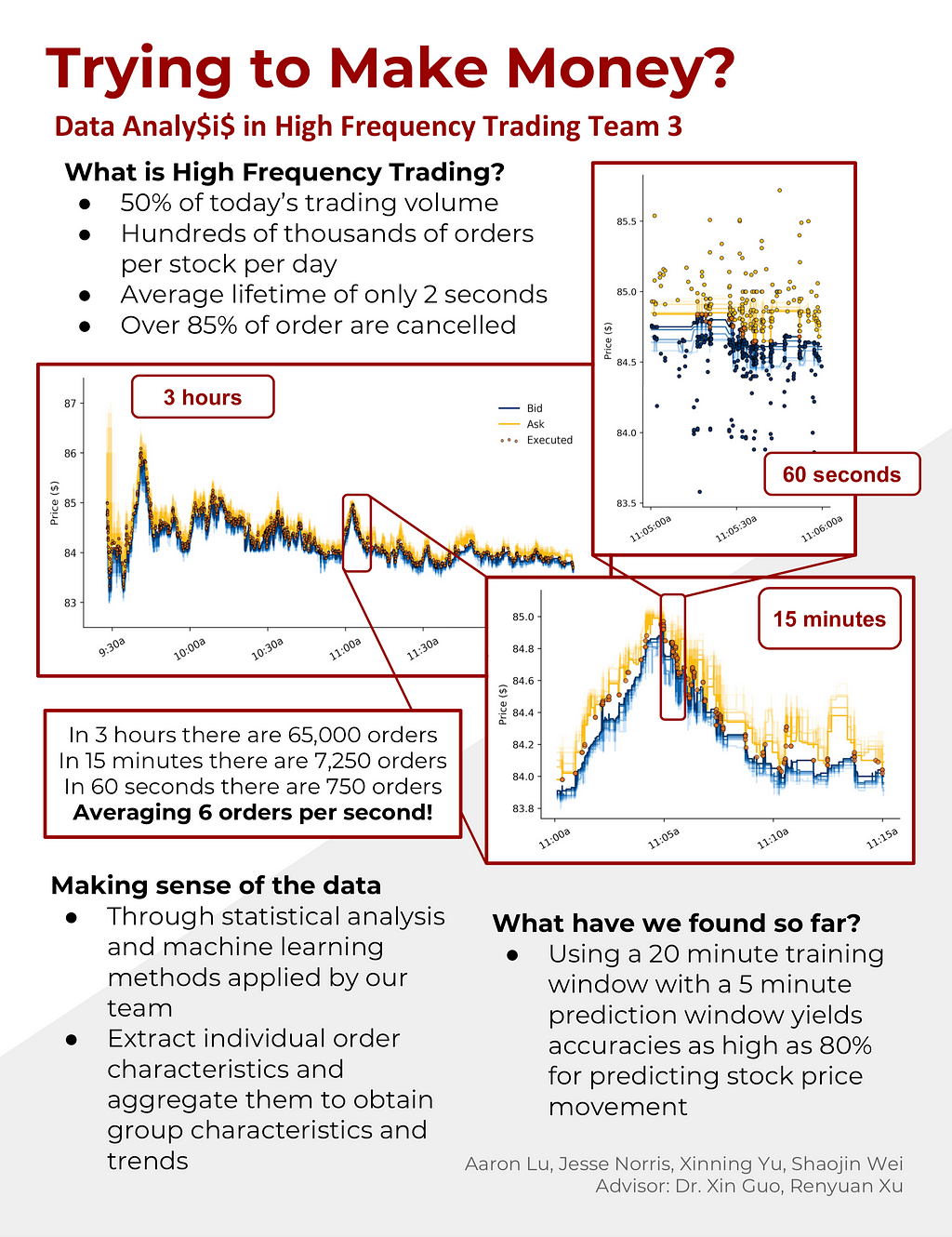

In the first semester, we require the students to learn a theoretical topic that is a critical tool, say Support Vector Machine (SVM) or linear regression, by reading books and papers. We ask them to write reports and give presentations on that particular topic. I told them, “You can always go to a lecture and learn things. But for you to learn and present and teach it to me, that’s a different level of understanding.”“You can always go to a lecture and learn things. But for you to learn and present and teach it to me, that’s a different level of understanding.”After that, we usually take a real problem that has been studied and published in a previous paper. It is not financial data. It’s usually medical, social network or shopping data. These data are usually cleaner (than financial data). They will apply the tools that they taught me to these data and analyze them. By the end of the semester, they report back to me what they have done. Because these are well-studied data, we have a benchmark to compare and see if students have learned the tools well enough to apply to real-world problems. Then the next semester is a challenging one. Now they need to tackle the real financial problems. They’ve done the “Tech” part. Now they need to do the “Fin” part. Financial data is usually very dirty. They need to learn how to clean the data. This is the same job that investment bankers have to do when they are first hired. So we train students to do this here. After cleaning the data, students use their now worked-up techniques on financial data. But usually, financial data is more difficult to analyze.

What makes financial data harder to analyze?

Let me give you an example. For medical data, if you want to tell cancerous cells from healthy cells, you analyze the data and the cells don’t know you are analyzing them. They don’t change so you have many repeated data to train and to analyze. Whereas for financial data, the data doesn’t repeat itself. This is called Time Series. The other difficulty is when you are trying to find signals in activities like trading, other people can see your trading behaviors. So there’s a game (theory) aspect called serial in it. whenever you find a signal, it will disappear after a while. But for data on other behaviors like shopping, people don’t change because they know you are studying them. So whatever you do, it doesn’t have an adversarial effect on the underlying dynamics.“The other difficulty is when you are trying to find signals in activities like trading, other people can see your trading behaviors.”So that’s why we put the actual financial data in the second semester and let the students train the “friendly” data first. That’s why some students say, “This is challenging. Can I do some other Capstone and still get a degree in FinTech?” No, you can’t. It’s challenging for a reason. But in the end, if you go into fields like machine learning or finance, they are going to be challenging as well. You need to be up for the challenge. But so far from what I hear, most students really like the projects. They want to learn more to be more competitive.

What did you learn from advising Capstone projects?

We’ve learned that students are different each year. Over years, the students’ knowledge have changed. In the beginning, nobody knew about machine learning. But now it’s already part of the campus. Everyone knows it. Also, it’s interesting when we give similar projects that have slightly different angles to different groups. You see that human beings are so different. Our ways of thinking are so different that they end up having very different approaches. And from a teacher’s perspective, when people who are active thinkers learn something from scratch, they sometimes ask questions that even experts in the field haven’t thought about. We are always amazed by how babies ask surprising questions. But it’s actually the same thing with students. They ask surprising questions that make you feel you need to learn more, even from the youngsters. I think that’s probably the best part about teaching.“We are always amazed by how babies ask surprising questions. But it’s actually the same thing with students. They ask surprising questions that make you feel you need to learn more.”

What are the projects that you are currently advising?

In one project, we are trying to use neural networks to learn images. This is coming from one of our own latest papers. Another project is about Support Vector Machine (SVM), a very popular machine learning tool for image studies. It tries to find a pattern to classify data points that can then be applied to new data to do prediction. It has many real-life applications. For example, in finance, it can be used to predict the direction of a market so that people can decide when to buy or sell.How can students make the most out of their MEng projects?

In the first stage, it’s important to really grasp the mathematical foundations. Then you will have more confidence for the second step. But mathematics is not enough. Especially for FinTech, a lot of students are afraid of the programming part. But both mathematics and programming are critical. They need to be able to write a program that is bug-free and also have the mathematical understanding to know how to build a model.

“Capstone projects provide them a benchmark for students to see where [they need] to improve.”

What do you think engineering leaders should be like?

I think a good engineer and leader needs to be a good thinker. You need to think about the best solution to the problem. You should also consider not just yourself, but also people around you. A good leader should be sensitive to what other people are thinking. You should also be a good technical thinker so that people will respect you. So a good leader should be both a strong technical person and also a conscientious thinker. I think the culture of Berkeley teaches this. Not only are we good at technical training, but we also highly encourage thinking about the society and the well-being of other people. This is one of the best parts about Berkeley.“Not only are we good at technical training, but we also highly encourage thinking about the society and the well-being of other people. This is one of the best parts about Berkeley.”

What will FinTech be like in the future?

Finance is still going to be here because it’s in human nature to make money. Technology-wise, it’s going to get more intense. Over the past decades, FinTech has taken different forms. The problems we have faced are different. The way we trade has changed a lot. But fundamentally, FinTech has always been here. In the old days, people used pen to crunch data. Now, we use tech. So our FinTech program might look different, but it is here to stay and it will adapt to the changes.What kind of projects do you hope to advise in the future?

Any problem that is interesting and has a nice combination of the fundamental tools that we hope the students can learn and real-world problems that students can apply these tools to. Any good Master’s or PhD program shouldn’t just teach you how to learn. It should teach you how to apply the knowledge you’ve learned to new problems. So any project that has this nature will be good. I don’t want problems that are so easy that they don’t challenge people to think. And problems that are too difficult aren’t good for Master’s students to gain experience either. It has to be the right level. I also want projects that give myself something new to learn.“Any good master or PhD program shouldn’t just teach you how to learn. It should teach you how to apply the knowledge you’ve learned to new problems.”Professor Guo is the Coleman Fung Chair Professor in Financial Modeling, housed in the Industrial Engineering and Operations Research (IEOR) department at UC Berkeley. Connect with Professor Guo.

Professor Xin Guo: ‘“In the old days, people used pen to crunch data. Now, we use tech” was originally published in Berkeley Master of Engineering on Medium, where people are continuing the conversation by highlighting and responding to this story.